How We Got Hooked On Chips

Taiwan, China, and the never-ending semiconductor revolution

As I am making the final edits to this article, the media are reporting that Chinese fighter jets are flying along the narrow strait separating China from Taiwan.

This dramatic gesture, along with other signals of military readiness, raises the spectre of a catastrophic conflict between the world’s two superpowers, China and the United States. I just hope that by the time this is published, you don’t have to read it in a bunker.

The immediate reason for this crisis is an official visit on Wednesday by Nancy Pelosi, the Speaker of the US House of Representatives, to Taiwan, an island that China claims as part of its territory. But remarkably, one of the deeper sources of this tension is a story about design.

Taiwan has something that every powerful nation on the planet wants, and needs access to. It has the Taiwan Semiconductor Manufacturing Company (TSMC), an industrial enterprise that manufactures half of the world’s semiconductors, or computer chips. More importantly, TSMC makes the vast majority of the most advanced logic chips (only South Korea’s Samsung can produce them to a similar standard). These advanced chips provide the computing power behind our most important gadgets, from smartphones and laptops to artificial intelligence, cloud software and state-of-the-art military technology.

Pelosi’s incendiary visit this week reflects a striking fact about the early-21st century: the world’s most powerful states cannot provide for themselves stamp-sized electronic components made in a factory. The precariousness of this situation has hit home in recent years, as trade-wars, lockdowns and supply chain disruptions have created a global semiconductor shortage. This cost the car industry an estimated $210 billion last year, while slashing Apple’s output by up to 10 million iPhones. Chip shortages are a major obstacle to US efforts to supply Ukraine with weapons (a Javelin rocket launcher uses around 250 semiconductors).

So why don’t states just make their own advanced chips? They are trying. The US and the European Union are each offering investments of around $50 billion for domestic semiconductor manufacturing. This will largely involve subsidising Intel, the last great American hope for advanced chip-making, in its ambitions to catch up with its rivals in Taiwan and South Korea. Meanwhile China, rapidly gaining ground in the chip race despite US efforts to hamper it, is spending much more than that.

It would be comforting to think that all this is just the result of complacency: that western governments did not realise their dangerous dependence on Taiwanese chips, and will now lessen that dependence. This would allow us to feel slightly more confident that a face-off over Taiwan will not provide the spark for World War Three.

The reality is more sobering. None of the plans being laid now appear likely to diminish the importance of Taiwan. What is more, TSMC represents only one aspect of the west’s dependence on Asia for the future of its chip industry. To understand why, we have to look at how semiconductors became the most astonishing design and engineering achievement of our age.

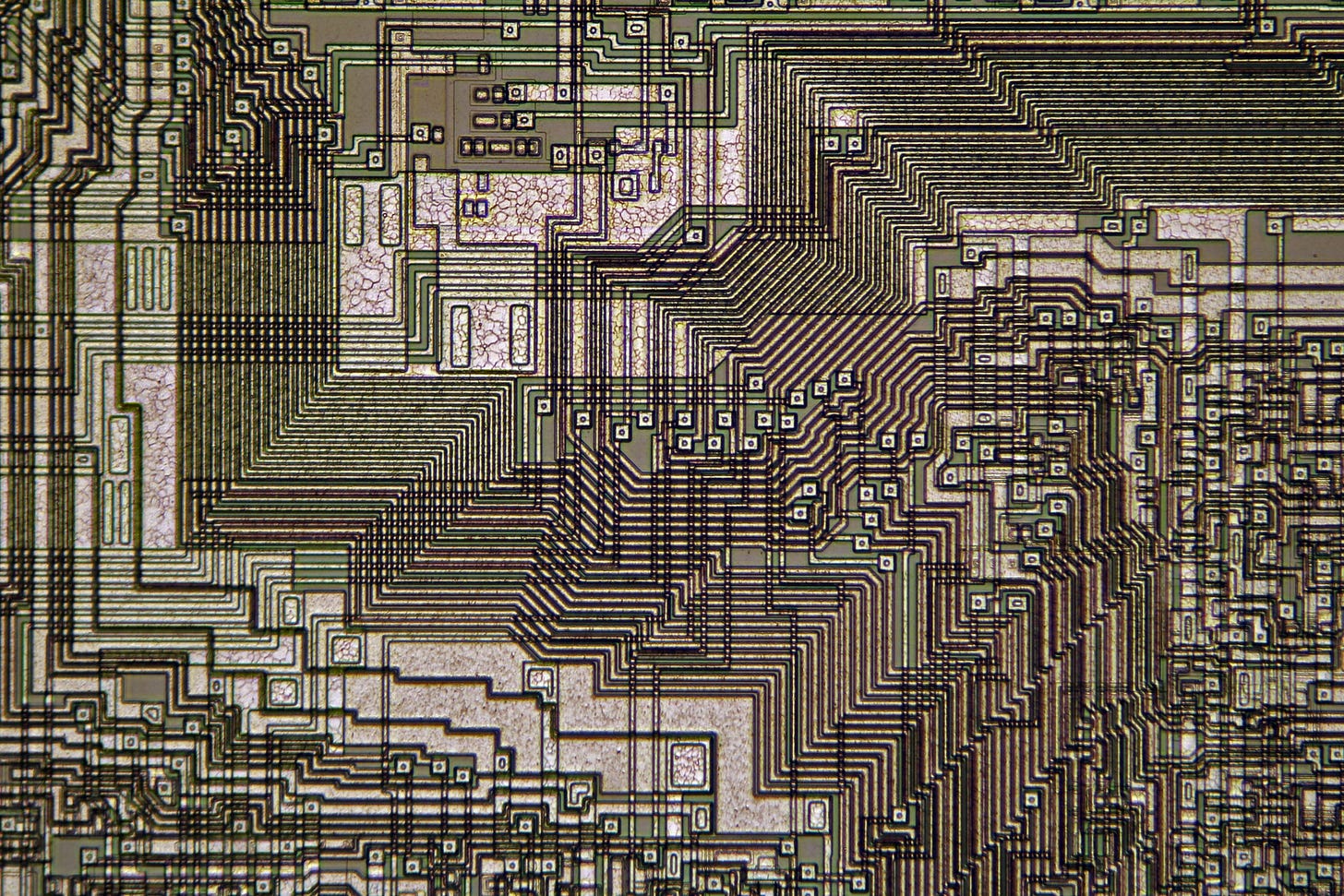

The surface of a computer chip is like a city, only it is measured not in miles, but in microns. This city is not made from buildings and streets, but from transistors etched in silicon: hundreds of millions of them carefully arranged in every square millimetre. Each transistor is essentially just a gate, which can be opened or closed to regulate an electric current. But billions of transistors, mapped out in a microscopic architecture, can serve as the brain of your smartphone.

Recognising our dependence on such artefacts is unnerving. It reveals how the texture of our lives is interwoven with economic and technological forces we can barely comprehend. Semiconductors are everywhere: in contactless cards, household appliances, solar panels, pacemakers, watches, and all kinds of medical equipment and transportation systems. Aside from the logic chips that provide computing ability, semiconductors are needed for functions like memory, power and remote connection. They are the intelligent hardware underpinning the entire virtual universe of the Internet: we think and feel and dream in languages that semiconductors have made possible.

All this is thanks to a somewhat esoteric doctrine known as Moore’s Law. In 1965, the research director Gordon Moore predicted that the number of transistors on a computer chip would double every year, an estimate he later revised to every two years. This was, in effect, a prediction of the exponential growth of computing power, as well as its falling cost, and it has proved remarkably accurate to this day. The strange thing is that Moore’s Law has no hard scientific underpinning: it was simply an extrapolation based on Moore’s observations of the early semiconductor industry. But his “law” has become an almost religious mission within that industry, a prescribed rate of progress that every generation of designers and engineers seeks to uphold.

The result has been an incredible series of innovations, allowing transistor density to keep increasing despite regular claims that the laws of physics won’t allow it. Moore’s Law gives semiconductor production its defining characteristic: chips are never something that you can learn how to make once and for all. Tomorrow’s chips are always just around the corner, and they will probably require a whole new technique.

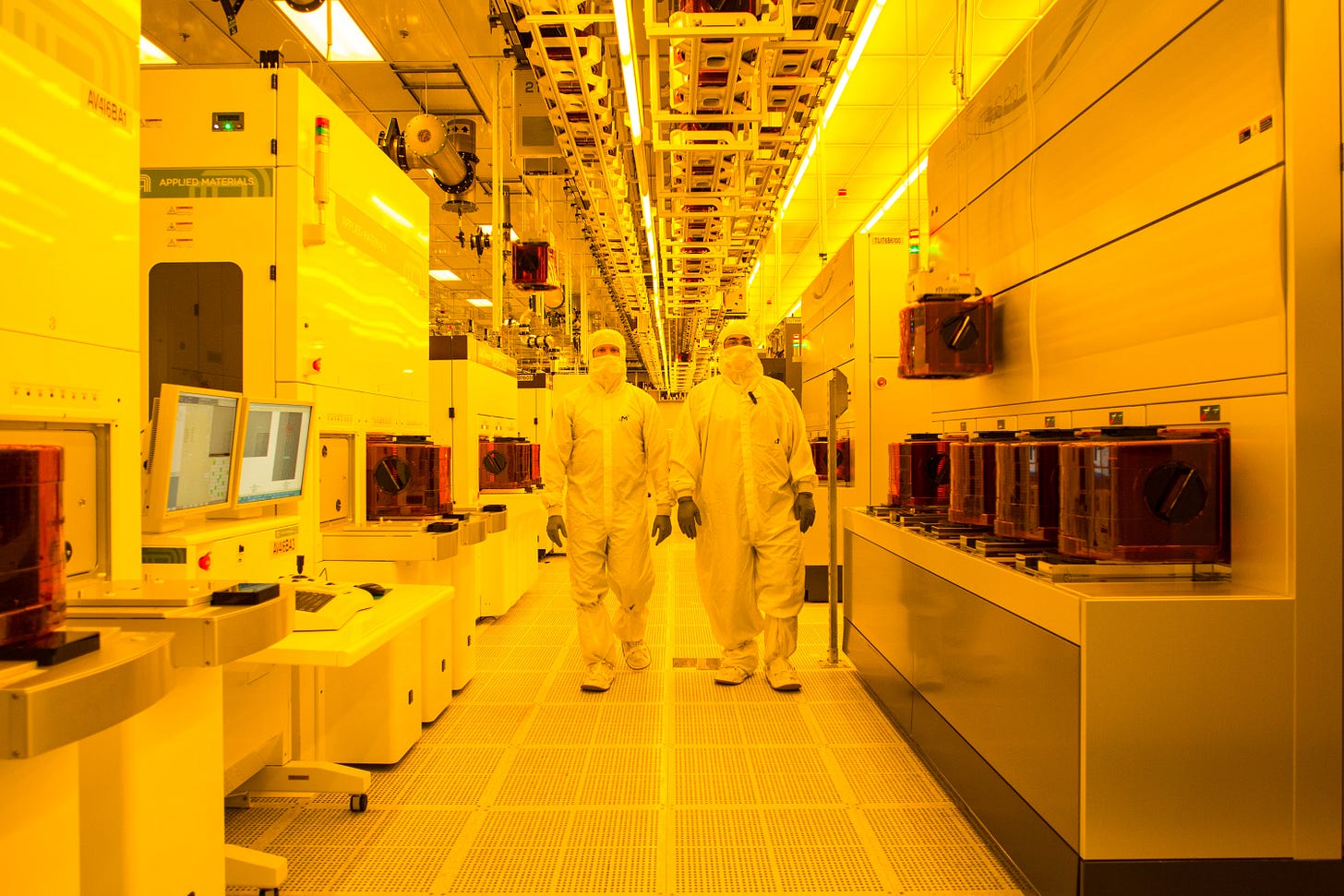

This is why, by the late 1980s, it was becoming financially impossible for the great majority of firms to manufacture advanced chips. Doing so, then as now, means placing huge bets on new ideas that might produce the next breakthrough demanded by Moore’s Law. It means spending billions of dollars on a factory, which needs enough orders so that it can run 24/7 and recoup its costs. And it means doing this in the knowledge that everything will need to be upgraded or replaced in a matter of years.

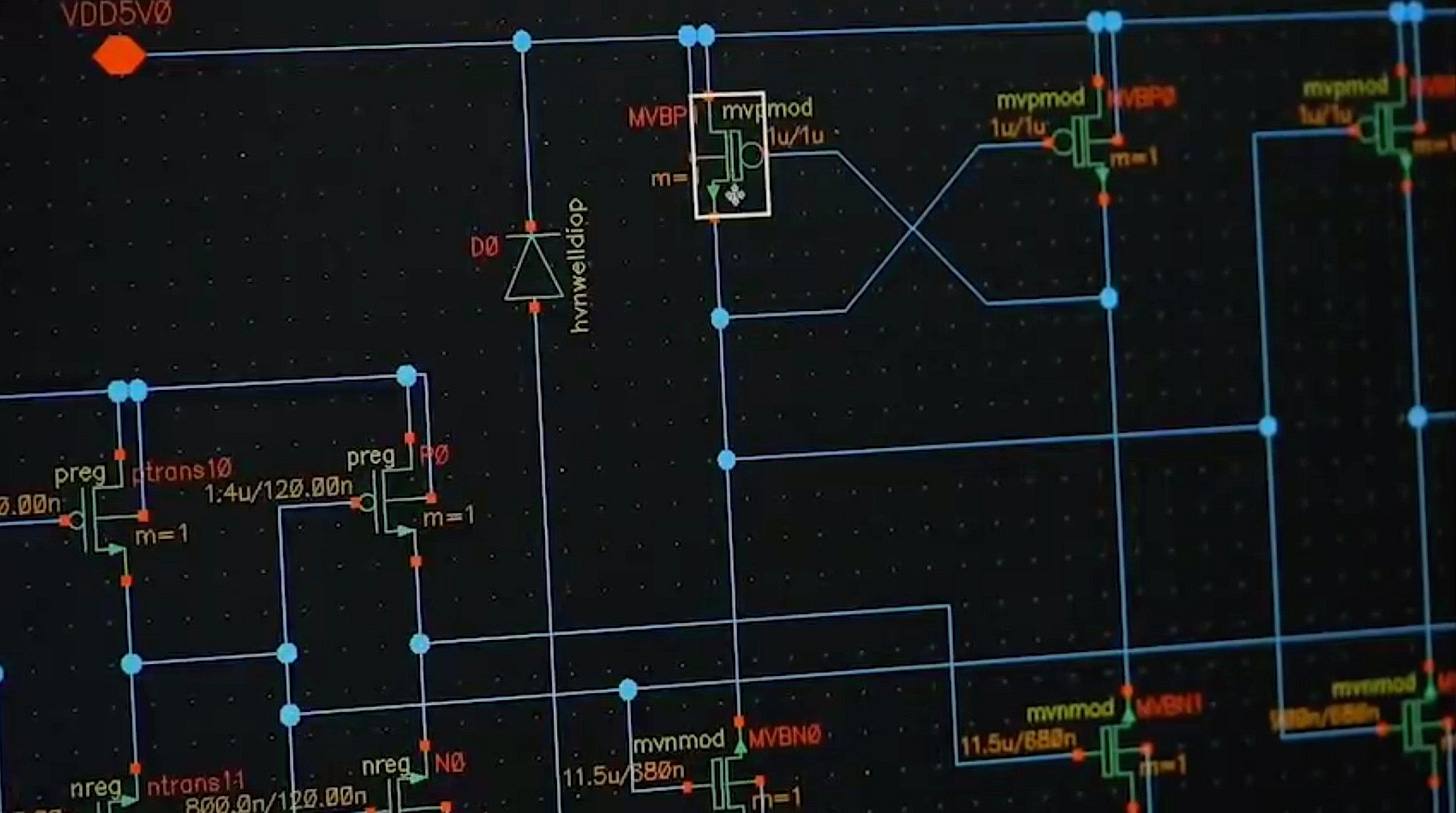

The solution to this impasse came in 1987 with the founding of TSMC, assisted, ironically enough, by engineers and technology transfers from the United States. The Taiwanese company’s key innovation was to focus purely on manufacturing, allowing all the other firms that want to make chips to specialise in design. With its gigantic order book, TSMC makes enough money to continuously invest in new manufacturing techniques. Meanwhile, companies such as British-based ARM, and Apple and Qualcomm in the US, have focused on designing ever more revolutionary chips to be manufactured by TSMC.

With this basic division of labour in place, the semiconductor industry became a highly specialised, intensely competitive global enterprise. It takes millions of research and engineering hours to design new chips, many of which are done in India to make the process faster and cheaper (up to date statistics are hard to find, but by 2007 just 57% of engineers at American chip companies were based in the US). The semiconductors are made in Taiwan with Dutch machinery and Japanese chemicals and components, before being taken to China for testing, assembly and installation. And increasingly, the profits needed to keep everything going come from Asian consumers.

This is how Moore’s Law has been upheld, and how we have received ever-improving gadgets over the past three decades. But this chip-making system relies on each of its key points developing intense expertise in a specific area, to deliver constant techno-scientific progress and cost efficiency. TSMC is one of those key points, and its skills and experience cannot simply be copied elsewhere.

It is worth taking a moment to appreciate the mind-bending process, known as Extreme Ultraviolet Lithography, by which TSMC makes the most cutting-edge chips. It involves a droplet of molten tin, half the size of a single hair’s breadth, falling through a vacuum and being vaporised by a laser that fires fifty thousand times per second. This produces a burst of light which you cannot actually see, since its short wavelength renders it invisible. After bouncing off numerous lenses, that light will meet the chemically treated surface of a silicon wafer, where, over the course of numerous projections, it will etch the billions of transistors that allow a chip to function. These transistors are hundreds of times smaller than the cells in our bodies, not much larger than molecules.

Now we can begin to grasp why America and Europe are unlikely to replicate TSMC on their own shores. In fact, the Taiwanese company already operates factories in the US, making less advanced chips; but as its founder Morris Chang recently revealed, the lack of industrial expertise there prevents it from being competitive. Chang called the whole idea of an American semiconductor revival “a very expensive exercise in futility.” Analysts have similarly poured scorn on the EU’s chip manufacturing ambitions.

Given the scale of the challenge, the investments on offer in the US and EU are practically chump change. They are already spent by companies like TSMC and Samsung every single year. And those companies can buy more with it too: according to one assessment, the cost of building and running a semiconductor plant in the US is one-third higher than in Taiwan, South Korea or Singapore. Another widely cited report estimated that if the US wanted semiconductor self-sufficiency, it would cost over $1 trillion, or twenty times the sum currently on offer.

As for the United Kingdom, the less said the better. The UK finds itself with a potentially pioneering semiconductor plant in Newport, Wales, but has allowed the research facility there to lapse into a storage area, and has been trying to sell it to a Chinese-owned company for several years. As Ed Conway concludes, the UK government’s semiconductor strategy is simply non-existent. Absurdly, the responsibility for devising one was given to the Department for Digital, Culture, Media and Sport.

In short, the US and Europe are a long way from making semiconductors at a scale and with a proficiency that would seriously reduce dependence on TSMC. It is not just about mastering the cutting-edge techniques of today; it is about generating enough revenue to research and develop the techniques of tomorrow. And it is not just about meeting current demand; it is about building capacity for a decade in which global demand is expected to double. Advanced chips will be needed for 5G gaming and video streaming, artificial intelligence and home offices.

I will leave it to the international relations people to assess what this means for US-China relations. The obvious conclusion is that western dependence on TSMC raises the stakes of a potential Chinese invasion of Taiwan, which in turn makes it more likely that the US will provoke China with its support for the island’s independence. But the picture is extremely knotty, given China’s own centrality to the business models of western companies, including chip designers.

What seems more clear is that the politics surrounding semiconductors in the west are highly misleading. Support for domestic chip-making has been tied into a narrative about moderating the excesses of globalisation and rebuilding industry at home. But in practice, we are talking about state subsidies for huge global companies which continue to rely on access to foreign labour markets and consumers. This contradiction is neatly captured by Intel banging the drum for more government investment, while simultaneously lobbying to ensure it can continue taking its technology to China.

Yet this is only fitting, since semiconductors are emblematic of the contradictions of post-1990s globalisation. A system defined by economic openness and expansion ultimately concentrated power in the hands of those supplying the most important resources, whether it be technological expertise or cheap fossil fuels. And even if the system unravels, our dependence on the resources will remain. The events surrounding Taiwan this week are just another reminder of that.

Great article, and very elegant description of the surface of a chip. Re: Moore's law, IBM & Samsung towards the end of last year unveiled a design which stacks the transistors vertically (https://www.siliconrepublic.com/machines/vtfet-ibm-samsung-chip-semiconductor), and so opens up new possibilities. The BCG report you link to suggests that a more feasible outcome from existing levels of investment (after so many years of relying on Taiwan) is re-establishing capacity for "essential" use cases ("demand for the advanced logic chips used in national security systems, aerospace, and critical infrastructure".) Beyond that, it does sound that enormous investment will be required.

Excellent article, except for the inaccurate reference to Samsung as a Japanese firm when it is a South Korean one.